Towards a Knowledge Recipe for State Corporations in the Financial Sector in Kenya

Abstract

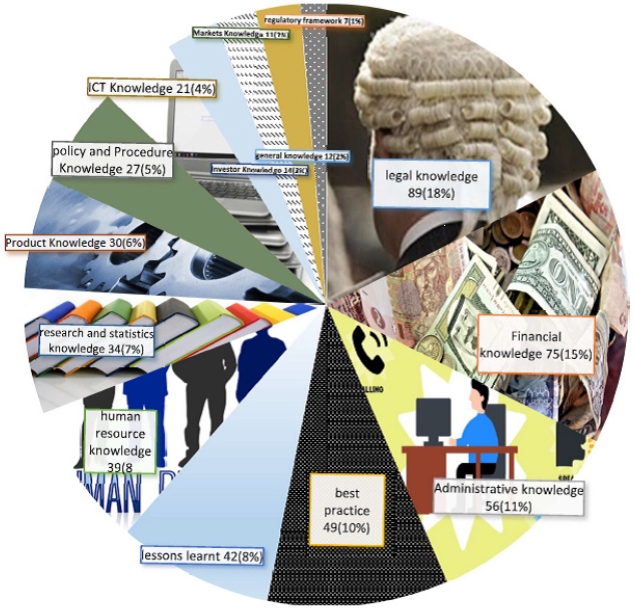

Knowledge recipes are packages of knowledge which arise from the process of combining the knowledge assets in the organization in distinctive ways. This involves converting them into useful outputs which are the ideal core competitive advantage enablers for companies. The major objective of this study was to propose a knowledge recipe for financial-sector state corporations in Kenya. The study adopted a convergent parallel mixed methods research design. Quantitative and qualitative data were collected using questionnaires and key informant interviews. The target population of the study was 1574 respondents drawn from all financial state corporations. A multistage sampling technique was used for the study. The first phase involved purposive sampling of the organizations to be studied whereby the four state corporations namely: Capital Markets Authority, Competition Authority of Kenya, Kenya Investment Authority, and Kenya Revenue Authority were identified. The second phase entailed stratified sampling of the respondents in three strata namely senior management team, knowledge management team, and general staff. The authors used a census of all senior management team and knowledge management staff while a simple random sampling technique was used for the general staff. By use of the Krejcie and Morgan table, the actual sample size was 358 respondents from all the four organizations. Data were collected using questionnaires and interview schedules. The qualitative data were analyzed using content analysis while the quantitative data were analyzed by the use of Ms. Excel and VOSviewer and presented using pie charts, bar graphs, and tables. The response rate for this study was 257 (72%). The study revealed that while most employees in the financial sector organizations understand their knowledge needs, knowledge types, knowledge uses and knowledge gaps, they do not have a universal knowledge recipe to facilitate effective knowledge management in their organizations. Consequently, the authors propose a universal knowledge recipe for the state corporations in the financial sector in Kenya. The ingredients of the recipe are legal-knowledge (18%), financial knowledge (15%), administrative knowledge (11%), best practice (10%), lessons learnt (8%), human resource knowledge (8%), research and statistics knowledge (7%), product knowledge (6%), policy and procedure knowledge (5%), ICT knowledge (4%), investor knowledge (3%), markets knowledge (2%), general knowledge (2%) and regulatory framework knowledge (1%).

Keywords:

Knowledge Management, Knowledge Needs, Knowledge Recipe, Financial Sector, State Corporations, Kenya1. Introduction

This section presents and discusses the background of the study as well as a statement of the study’s rationale.

1.1 Background of the study

Lucena (2016) argues that an industrial transformation has occurred leading to organizations majoring in high-value products and services. The quest to achieve this goal has led to many organizations becoming innovative and strategic, hence embracing knowledge management as one of the key strategies. Alavi and Leidner (2001) aver that to create and maintain business value, organizations need to capture and manage knowledge as it is considered a key resource in business development.

As much as knowledge management is crucial, the major problem hindering its effective implementation is the lack of a proper distinction between information and knowledge. This leads to a lack of a clear definition of the boundaries between information and knowledge management. Due to the confusion between the meaning of information and knowledge, the concepts of information management and knowledge management are not clearly articulated in the literature (Bouthillier & Shearer, 2002). With many organizations practicing information management they most times miss out on capturing the knowledge in people and systems hence not getting the distinction between what they capture and whatever they miss.

As part of the Government of Kenya’s development strategy, as indicated in the Vision 2030 blueprint, the government prioritizes knowledge management programs in state corporations in an effort to transform Kenya into a knowledge-led economy by 2030. This strategic vision has made the government appreciate knowledge management as a valuable vehicle towards sustainable development. The Government of Kenya has therefore charted the way forward for knowledge management on a “comply or explain” basis whereby the state corporations are required to comply with the knowledge management requirements or explain why they cannot (State Corporations Advisory Committee, 2015). Based on this government directive, most state corporations began or are in the implementation phase of knowledge. management.

Mosoti and Masheka (2010) conducted a study which found out that most organizations in Kenya do not understand knowledge management as much as they are practicing it. This is due to the fact that they are not able to incorporate knowledge management into their organizational strategy, leadership, and culture. This is a major knowledge management problem in state corporations in Kenya. They all understand knowledge management differently. Therefore, they are implementing knowledge management initiatives differently as they understand it in each particular organization.

1.2 Problem Statement

With the state corporations in the financial sector in Kenya rushing to comply with the 2015 government directive on knowledge management, there is an influx in state corporations in Kenya implementing knowledge management currently. There is minimal understanding of knowledge management in Kenya occasioned by the fact that knowledge management is a new idea in Kenya, and all the organizations understand and are implementing it differently based on their interpretation of the concept.

The ambiguous implementation of knowledge management coupled with the fact that the existing knowledge management practices are either too theoretical or academic and too complex with interfaces which are difficult to manage, makes knowledge management a nightmare for many of these state corporations. This leads to the failure of many knowledge management initiatives being implemented and to curb this challenge, semantically meaningful definitions of both explicit and tacit knowledge should be developed to enhance the knowledge management process (Lucena, 2016). The researchers sought to standardize the process of packaging knowledge through a knowledge recipe for the state corporations in the financial sector in Kenya.

1.3 Rationale for Knowledge Recipes

Every organization practicing knowledge management should consider having value packs in terms of packaged knowledge, also referred to as knowledge recipes, as its competitive advantage enablers (Al-Ali, 2003). These value packs are essential if well packaged and managed so as to be accessible and usable for the right purposes. According to Edvinsson and Stenfelt (1999), Swedish telecom companies created network organizations and competence alliances which are facilitated by sharing and maintenance of knowledge recipes. This led to the companies increasing their profitability by enhanced processes and extra income from the sale of the knowledge recipes as part of their intellectual property. Therefore, the proper capture, organization, and packaging of knowledge lead to great value addition and further increases the competitive nature of the organization. The financial sector in Kenya is integrated since most of the organizations in this sector require similar knowledge sets to perform their duties. This, therefore, means that having a universal knowledge recipe will lead to improved access and sharing of knowledge hence resulting in increased synergy and more effective execution of joint tasks.

According to Ramasami (2011), a knowledge recipe is an outcome of the transformational process that draws its inputs from knowledge assets existing in an organization and converts them into useful outputs by combining them in distinctive ways. The concept of knowledge recipes was first fronted by Skandia, a Swedish financial company, which categorized them as intellectual capital alongside its trademarks and patents. Skandia referred to the knowledge recipes as packaged knowledge or value packs which it shared with partners, staff and financial advisors to educate them on matters such as market trends to understand the best products for their customers (Al-Ali, 2003). The concept of knowledge recipes is the central theme of this study. The authors were interested in finding out the “ingredients” of knowledge recipes in state corporations in the financial sector in Kenya so as to be able to recommend a universal recipe for these organizations.

1.4 Contextual setting

This study was carried out in four organizations in the financial sector in Kenya. The four were selected due to prior identification of established knowledge management practices in these organizations. The organizations are Capital Markets Authority which is a state corporation mandated with the task of development and regulation of the Capital Markets industry in Kenya; Competition Authority of Kenya whose mandate is to enhance the welfare of the people of Kenya by promoting and protecting effective competition in markets and preventing misleading market conduct throughout Kenya; Kenya Investment Authority which was set up to promote and facilitate domestic and foreign investment in Kenya by advocating for a conducive investment climate, providing accurate information and offering quality services for a prosperous nation; and Kenya Revenue Authority which is charged with the responsibility of collecting revenue on behalf of the government of Kenya.

2. Literature review

The concept of knowledge recipes was advanced by Skandia, which is a savings and investment company based in Stockholm, Sweden. This company has a large number of subsidiaries and partners. Skandia included knowledge recipes, which is referred to as packaged knowledge packets, in its list of intellectual capital alongside intangible rights, trademarks, business secrets, and patents (Al-Ali, 2003). All these were regarded as the organization’s intellectual property and with proper use of this intellectual property, Skandia managed to beat its competitors to a number of markets. It also opened new commercial markets by offering its intellectual property for sale, which included knowledge recipes, to partners. The knowledge recipes were also used by Skandia’s financial advisors to understand the best products for its customers and thus put it in a position to advise the clients properly.

Holsapple (2003) avers that packaging knowledge gives economies of scale to an organization as well as adding value to its knowledge assets. He goes on to state that the staff of the organization can be part of the knowledge package since they hold crucial tacit knowledge. They can be consulted by the purchasers of the package to gain deeper insights on the knowledge packages or for cases of software they can provide user support. Organizational knowledge can as well be packaged in experts by training and mapping them by the knowledge they hold and then be able to use their knowledge by making them facilitate training and also make specialized products. This makes a hybrid knowledge packaging approach (Holsapple, 2003).

Packaging knowledge in an organization can lead to several opportunities and products which include expertise for sale whereby experts in the organization develop more products beyond the company’s traditional products. This opens up new markets for the new products, hence gaining value for the organization. Consultancy is also another product of knowledge packaging whereby an organization develops a pool of expertise which it can lease out to potential clients in the area. Information products such as magazines and smart products can be sold by an organization which manufactures the products while gaining additional value by publishing part of its expertise. The smart products use packages of knowledge which build on their memory and learning hence making knowledge core in their operations.

The more structured and packaged the knowledge, the easier it is to share and deliver over electronic media. This can be both an advantage and disadvantage to the organization since the organization can lose its knowledge resources to competitors through espionage. It can also be an advantage since the organization is able to share much knowledge and thus adding more value.

In consideration of the above, the authors perceive knowledge recipes as distinct packages of knowledge. These are to be used as competitive advantage enablers considering the fact that they make knowledge retrieval easier and thus enhancing knowledge sharing and application. These recipes lead to efficient use of knowledge resources and also aid in maximizing knowledge documentation considering the fact that the staff has an understanding of where to store a particular knowledge set. The authors established that in Kenya there is no research on knowledge recipes, hence there is no specific knowledge set for financial state corporations in Kenya to adopt.

3. Methodology

This study used a mixed-methods research design. According to Creswell (2014), mixed methods research is the collection and analysis of data by integrating and mixing both qualitative and quantitative data. The population of the study comprised of all staff members at the headquarters of state corporations in the financial sector in Kenya. According to the Ministry of Finance (2017), there are sixteen state corporations in the financial sector in Kenya listed on its website*. All these being state corporations in the financial sector, their staff formed this study’s population. The population of the staff from these state corporations was one thousand five hundred and seventy-four (1574). The research adopted a multi-stage sampling technique whereby the first phase entailed the selection of state corporations to participate in the study. This was achieved by the use of information-oriented purposive sampling whereby the researchers chose the organizations to be studied based on prior identification of knowledge management practices in these organizations. The second stage of sampling was to determine the actual respondents in the four organizations. In this phase, the authors used stratified sampling based on job functions. Thus, the following three strata were developed: Senior Management Team (SMT); Knowledge Management Staff (KMS) and General Staff (GS). From these strata, the authors conducted a census of the senior management team and knowledge management staff. This is because they are directly involved in the implementation of knowledge management policies within the organizations. Thereafter, a simple random sampling technique was used to identify the actual respondents from the general staff.

Data was collected using interviews and questionnaires. The researcher conducted a thematic analysis of the qualitative data collected. According to Castleberry and Nolen (2018), thematic analysis is a method of identifying, analyzing, and reporting patterns or themes within data. The qualitative data were presented using a textual display and verbatim. On the other hand, Quantitative data was analyzed statistically using VOSviewer and MS Excel and then represented by the use of tables, pie charts, and bar graphs.

4. Results

This section discusses the findings of the study by reporting the response rate, knowledge needs and knowledge recipes in the organizations. Both qualitative and quantitative data were combined and presented and analyzed collectively.

4.1 Response rate

Data analysis for this study was based on responses from questionnaires administered and interviews conducted by the researcher. The researcher found out the response rates by getting a percentage of the total responses against the sample size. CMA had a response rate of 66 (86%); CAK 34 (60%); KenInvest 27 (63%) and KRA 130 (72%). Overall, the four institutions had a response rate of 257 (72%). Out of the sample, 101 (28%) did not participate in the research. This is a very good response rate according to Kothari (2014) who asserts that a response rate of above 70% is deemed to be very good for data analysis. This is as shown in Table 1.

4.2 Organizational knowledge needs for the four organizations

As explained earlier, this study was conducted in four different organizations in the financial sector in Kenya. With the organizations having different mandates based on the legal basis of their formation, their knowledge needs are different and in line with the organization’s activities. Although their knowledge needs are different, the organizations being under the same sector, the financial sector in Kenya, they have a point of convergence whereby their knowledge needs are similar. The knowledge needs of individual organizations are presented below.

In CAK, the most needed knowledge is on consumer protection, which occurs 19 times, followed by knowledge on competition law which was selected by 15 respondents. Technology and systems knowledge was also selected by 14 respondents while international best practices were picked by 12 of the respondents. 9 respondents selected policies and procedures knowledge; 8 respondents selected market trends while 6 chose information and communication technology.

In CMA, the majority (60) of the respondents require knowledge on capital markets products while 58 respondents require legal knowledge. 54 respondents need knowledge on capital markets regulations while 49 respondents need knowledge on economic performance measurements. Further, 48 respondents need knowledge on financial analysis; 38 respondents need knowledge on market trends; 36 respondents need knowledge on accounting and financial reporting with a further 23 respondents selecting best practices as the knowledge that they need. 19 respondents need knowledge on governance while information communication technology (ICT) knowledge is needed by 11 respondents with a further 9 being in need of knowledge on projects.

In KRA, the majority (120) selected tax administration as the area of their knowledge need; 118 respondents need knowledge on tax planning with a further 109 selecting best practices as the knowledge that they need. Legal knowledge is needed by 102 of the respondents while 94 respondents need revenue forecasting knowledge. Further, 92 respondents need tax systems knowledge; 81 respondents need financial modeling knowledge while 72 respondents need knowledge on emerging and current trends. 68 respondents need knowledge on economic performance with a further 64 being in need of knowledge on accounting and finance. 58 were in need of knowledge on policies and procedures. Knowledge on Information Communication Technology was noted as a requirement by 42 of the respondents. 38 respondents needed knowledge on the human resources operations and procedures with a paltry 12 respondents being in need of knowledge on records management.

The findings reveal that the knowledge needed most in the organization is investment knowledge which is needed by 23 of the respondents. This is closely followed by investment opportunities in Kenya needed by 21 respondents; sectorial economic performance knowledge follows by being selected by 19 respondents; 17 respondents need knowledge on the legal framework surrounding the investment industry in Kenya; 15 respondents need knowledge on investor education followed closely by investor protection knowledge at 12 respondents; financial knowledge is required by 11 of the respondents; 9 respondents need knowledge on foreign and direct investments with a further 6 respondents needing knowledge on investor relations.

4.3 Knowledge recipes

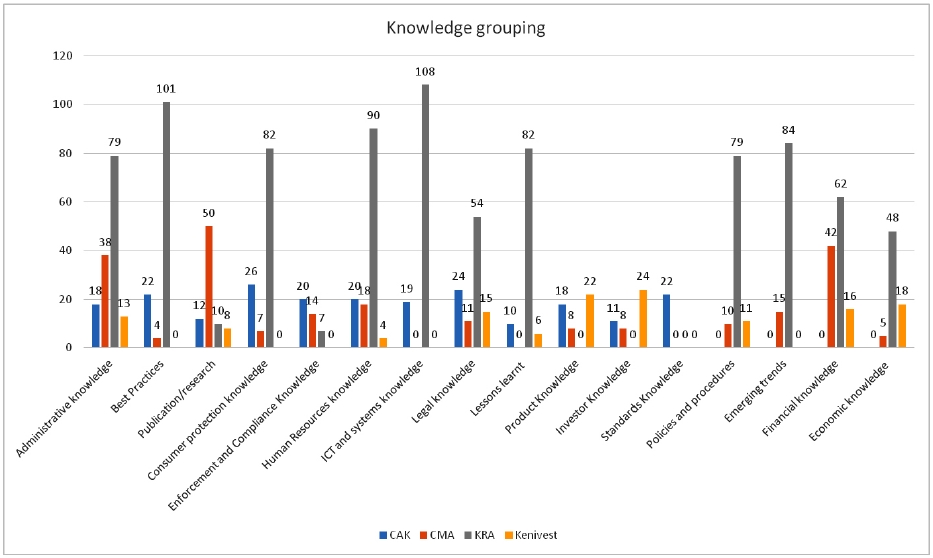

The authors sought to find out the possible groupings for the study organizations’ knowledge. This was to form the basis for proposing the knowledge recipes. The authors found out the following knowledge groupings in each of the organizations.

At the Competition Authority of Kenya, the knowledge sets identified to form their knowledge recipe included consumer protection knowledge, selected by a majority (26) of the respondents. This was closely followed by legal knowledge which was proposed by 24 respondents. A further 22 respondents proposed both practices and standards knowledge. 20 respondents suggested that enforcement and compliance knowledge and human resources knowledge should be among the knowledge sets in the organization. 19 respondents suggested ICT and systems knowledge. 18 respondents chose mergers and administrative knowledge to be part of the organization’s knowledge sets. Other 12, 11, and 10 respondents proposed publications, project knowledge, and lessons learnt respectively. Some of the responses are reported hereunder verbatim.

“The most prevalent knowledge at CAK is competition laws, competition policy guidance notes and knowledge on the day to day running of the organization. I will therefore propose legal, policy and best practices as our key knowledge groupings”

“We engage in many projects with different outcomes therefore I will expect to have project knowledge, lessons learnt and ICT and systems as our core knowledge groups”

“Legal knowledge is the most crucial in our organization since we base our operations on the law, we also bank on ICT and systems. In my opinion these should be the core knowledge groupings that we should have at CAK”

At the Capital Markets Authority, the respondents suggested a number of possible knowledge groupings for the organization. These were arranged in their order of preference based on the number of respondents who suggested them. The most preferred knowledge set in CMA was financial knowledge suggested by 42 respondents while project knowledge and best practices were picked by 4 respondents. The other knowledge sets were: administrative knowledge (38 respondents), human capital and change management (18 respondents), market operations knowledge (15 respondents), regulatory and policy knowledge (14 respondents), legal knowledge (11 respondents), research and capital markets (10 respondents), business analytics, innovation and knowledge management (10 respondents). 8 respondents suggested both product knowledge and investor knowledge; 7 respondents suggested investigations and enforcement knowledge and licensing and approvals knowledge; while economics knowledge was selected by 4 respondents. Some of the responses are reported verbatim hereunder.

“At the Authority, we believe that financial knowledge is the key ingredient in the running of the industry with policy guidelines, market operations, knowledge management and best practices being the major groupings of knowledge that I propose to have at the Authority”

“Our knowledge should be grouped based on the departments and sections that we have at CMA since this forms the basis of our operations and therefore can be used to form the knowledge taxonomy for ease of access based on the understanding that people search for knowledge based on the different sections. For instance, people seeking financial services will identify with the Finance section hence this can form a basis for grouping knowledge”

“An understanding of the products, legal frameworks and policy guidance notes on the individual products makes one a complete part of this industry. I therefore propose these three key areas to form part of the knowledge groupings or recipes for the Authority”

“As a HR practitioner I believe that human capital knowledge is a key category, as well as lessons learnt and best practices for organizational learning. This coupled with market operations, finance and legal knowledge form the major knowledge groupings that I expect us to have at CMA”

Kenya Revenue Authority’s knowledge can be classified into 11 broad categories as identified by respondents from the authority. The groupings include ICT and systems knowledge suggested by 108 respondents, best practices (101 respondents), human capital knowledge (90), emerging trends (84), revenue administration knowledge (82), and lessons learnt (82). 79 respondents suggested administration knowledge and policies and procedures. 61 respondents suggested financial knowledge as one of the knowledge sets. 54 respondents suggested legal knowledge, and 48 respondents suggested revenue legislation as one of the knowledge grouping. Some of the responses are reported verbatim below.

“KRA is a very large organization with different areas and sections which have a role to play in the whole success. All these are crucial but I think ICT and systems knowledge, policies and procedures, best practices and revenue administration knowledge form our knowledge grouping. This is due to the fact that these hold a key significance to the KRA”

“We already have an existing knowledge management section which has mapped the categories and thus grouping the knowledge at KRA, though they missed out on process reports since I believe this are critical in guiding the new staff to learn and get guidance when undertaking their various duties”

“At KRA, we have distinct categories of knowledge which include best practices, lessons learnt, ICT and systems, tax administration, human resources, legal and financial among many others. This is crucial since it leads to ease of identification of knowledge. This shows that KRA is a leader in knowledge management”

“I believe that the various departments in an organization can form the basis for knowledge groupings. For instance, our cleaners have knowledge to share; this can be under administrative knowledge or operational/process knowledge. This should be how knowledge should be categorized. So far the few categories that we have at KRA are not a true representation of the knowledge that is held within for it only considers the technical areas leaving out the support sections”

“The ones that we have at KRA are representative and I believe this will be shared by the KM team. But legal, tax administration, financial and ICT knowledge are the key categories that I believe can form part of a knowledge recipe for a state corporation in the financial sector in Kenya.”

“Sometimes I get confused between information and knowledge. There is so much information at KRA which will require much intervention to categorize but for knowledge I can’t clearly tell because I can’t distinctively tell the difference since I am a bit new to the organization and I haven’t got the chance to understand the operations of the KM team.”

At the Kenya Investment Authority, the respondents suggested 11 knowledge sets to form their knowledge recipe. These knowledge sets include investor education and protection knowledge (18%), investment promotion knowledge (16%), economic development knowledge (13%), financial and accounting knowledge (12%), legal knowledge (11%), managerial knowledge (9%), policies and procedures (8%), research reports (6%), lessons learnt (4%) and human resource knowledge (3%).

“At KenInvest, investor education and protection knowledge is key and should form one of the knowledge groups alongside lessons learnt, best practices and financial knowledge”

“From where I sit, managerial knowledge is key alongside human resources, policies and procedures, legal and investor protection knowledge and therefore they should form the basis for knowledge grouping at KenInvest”

“As a foundation for knowledge management, we have identified investor education, investor protection, legal, financial, lessons learnt, best practices, legal knowledge, financial knowledge, economic and social development knowledge as our knowledge groups although we are open to establishing more and we will appreciate the findings of your study to help us to achieve this”

4.4 Knowledge grouping in the four organizations

The knowledge groupings in the four organizations are as shown in Fig. 1. KRA’s highest knowledge set was in ICT (108); followed by best practices (101) and emerging trends (84). CAK’s highest was consumer protection knowledge (26) followed by legal knowledge (24); CMA’s highest was research (50) and financial knowledge (42) second while KenInvest’s highest knowledge set was investor knowledge (22).

5. Discussion of the Findings

One of the objectives of this study was to find out the knowledge needs of the organizations under study. This objective had the sole purpose of identifying what the respondents thought or knew as the knowledge needs of their organizations. This is because different organizations may have different knowledge needs based on their specialization. Studies such as Huck (2009), Given, Forcier, and Rathi (2013) as well as Rathi, Given, and Forcier (2016) support this view. McCann and Buckner (2004) also concur that different organizations have different knowledge needs depending on their area of operation. The findings of this study show that at least in all of the study organizations, the respondents understood the organizational knowledge needs albeit at different levels. For instance, as much as some knowledge needs such as legal, lessons learnt and process knowledge are universal needs, consumer protection, capital markets products, tax administration, and investment knowledge are specific knowledge sets needed by CAK, CMA, KRA, and KenInvest respectively. This is due to the fact that the four organizations studied have different mandates and legal obligations but since they are all in the financial sector, they have a number of similar knowledge needs.

Therefore, it is evident from the data that financial-sector organizations in Kenya understand the crucial knowledge needs to be required for organizational success. These findings are in agreement with a study by Rathi, Given, and Forcier (2016) which revealed that the knowledge needs of an organization are crucial for success since it sets a foundation for understanding the organization’s objectives, mission, vision, and strategy. Having specific knowledge such as tax administration for KRA, Consumer protection for CAK, Capital Markets Products for CMA and Investor protection for KenInvest is a clear testament that all these organizations understand the knowledge sets that are crucial for their operations. Therefore, with an understanding of their crucial knowledge needs, the organizations are able to set priorities of the knowledge needs so as to effectively identify, acquire and maintain only the crucial knowledge assets to avoid a knowledge overload.

The main objective of this research study was to propose a knowledge recipe for the financial sector state corporations in Kenya based on the findings of the study. Holsapple (2003) agrees that having a knowledge recipe will cut down the lengthy procedures involved in identifying what is considered as knowledge and what is not; access to this knowledge; the use and the continuous creation and generation of knowledge that helps with day to day running of business activities. By identifying the role of each and every organization independently, a knowledge set was created that collectively encompasses the knowledge packages considered essential to implementing the key responsibilities of each sector. Al-Ali (2003) recognizes these packages as organizational intellectual property that creates several opportunities. Alavi and Leidner (2001) support this view arguing that in order to create and maintain business value, knowledge has to be captured and strategically managed as a key resource. The proposed knowledge recipe is in Fig. 2.

6. Conclusion

The authors observed that in order for a knowledge recipe to be successfully implemented, financial organizations in Kenya should not primarily prioritize financial products and services over knowledge products. Furthermore, knowledge gaps have been created as a result of financial state organizations having deficient value control over both external and internal products and knowledge. The study revealed that KRA, CAK, CMA and KenInvest have embraced various attributes of knowledge applications. Some of these include traditional and international best practices, policies and procedures, information communication technology systems, market trends, legal knowledge and financial analysis knowledge which are key components of economic performance.

This study may be beneficial to the management of corporate bodies which may use its findings to understand the knowledge recipes in their organizations, their value, and the requirements for their implementation. The paper may serve as a guide for the justification of the need for the knowledge recipes and also aid in the implementation of the concept. Specifically, the five organizations understudy may use the recommendations of this paper to improve knowledge management more especially on the creation and use of knowledge recipes to gain competitive advantage, enhance collaboration, and value addition to the organizations’ products and services. The paper may also be beneficial to students and instructors in the knowledge management discipline. It can support efforts to understand what knowledge recipes are and may contribute to their research, teaching, and learning on the subject. Since there is insufficient research material on this topic, this paper is an addition to the knowledge universe of knowledge management.

7. Recommendation

The authors hereby propose a knowledge recipe for the state corporations in the financial sector in Kenya. This knowledge recipe is shown in Fig. 2.

The universal knowledge sets for the state corporations are legal knowledge, financial knowledge, administrative knowledge, best practice, lessons learnt, human resource knowledge, research and statistics knowledge, product knowledge, policy and procedure knowledge, ICT knowledge, investor knowledge, markets knowledge, general knowledge, and regulatory framework knowledge. These knowledge sets form the proposed knowledge recipes for the state corporations in the financial sector in Kenya. They are discussed as below.

Legal knowledge

Legal knowledge is the most prevalent type of knowledge in all the study organizations. This is due to the fact that the financial sector is characterized by many legal processes such as the signing of contracts, drafting of policies and also compliance which is also a key function in this sector. The functions and mandates of these organizations are anchored on acts of parliament which formed them and therefore even the understanding of one’s roles requires legal knowledge. Therefore, to enhance and support the majority of the processes in these organizations, the staff require legal knowledge. The proportion for this knowledge should be considered to cover around 18% of all the organizational knowledge.

Financial knowledge

This is the second most prevalent knowledge set. The financial knowledge covers basic financial operations necessary for the day to day running of the organization. Considering the fact that all the state corporations under study are in the financial sector, they have a part to play in the sector. For instance, in CMA, the knowledge on the operation of the securities market is key to the organization while KRA needs knowledge on the tax dynamics. CAK requires knowledge on fair competition and its dynamics while KenInvest requires knowledge on the investment opportunities available in Kenya. It is therefore evident that all the organizations under study require this financial knowledge for their operation. The proportion of this knowledge is about 15% of all the knowledge.

Administrative knowledge

This is the knowledge that is required to enable one to make decisions in the day to day running of the organization. This knowledge is majorly required by management and also supervisors who are involved in making decisions and supervising the activities in the organizations. The authors found that this knowledge is required in all the organizations under study thereby making it a candidate for the knowledge recipe. The proportion of this knowledge should be 11% of all the knowledge.

Best practices

Best practices are the processes and procedures deemed to be efficient and sustainable. All the organizations under study identified knowledge on best practices as required in the organizations. This is in consideration of the fact that all these organizations are seeking continuous improvement and efficiency in their processes. This knowledge set is crucial since it helps in developing the organizations’ capacity since best practices are usually tried out and tested approaches which have worked properly. Therefore, best practices are an ideal candidate for the recipe. The proportion for this knowledge should be 10% of all the knowledge.

Lessons learnt

These are the major incidences and new lessons learnt from on-going or already completed projects. The financial sector state corporations are engaged in several processes through which staff learn several lessons which are valuable to the future and other projects the organizations are engaged in. The staff in all the study organizations appreciate the role that lessons learnt play in the success of successive projects. With this acceptance by all the study organizations, lessons learnt are a candidate for inclusion in the knowledge recipe. The proportion for this knowledge should be 8% of all the knowledge.

Human resource knowledge

This is knowledge of the administration and management of the organizations’ human capital. This is a universal knowledge type which cuts across all the study organizations. It is of interest to both the human resources staff and the other staff in the organizations. For instance, the staff wants to know their benefits, staff policies and whatever that is of interest to them in their work environment. This, therefore, makes this knowledge crucial in all the organizations hence making it a candidate for the knowledge recipe. The proportion for this knowledge should be 8% of all the knowledge.

Research and statistics knowledge

The financial sector is a rapidly changing and dynamic industry. This is due to several micro and macro-economic influences. To keep up with these changes and operate in such an environment, the study organizations indicated that they need to have functional research sections which share their reports as soon as possible to enable the other staff to keep up with their work and access up to date working reports. This, therefore, necessitates the need for the research knowledge. The staff also need the knowledge on research and statistics to perform their own studies so as to facilitate their works. The proportion for this knowledge should be 7% of all the knowledge.

Product knowledge

As part of the recipe, the study revealed that KenInvest and CMA have well-structured products which are the value drivers for their businesses. KRA has diverse tax products which are aligned to its operational mandate this therefore makes products a crucial candidate of the knowledge recipe. The proportion for this knowledge should be 6% of all the knowledge.

Policy and procedure knowledge

Policies and procedures form part of the key administration documents in every organization. The staff in all the study organizations indicated a desire to get knowledge on policies and procedures ranging from the government policies to the individual organizations’ policies. With this consideration, policies and procedures are part of the knowledge recipe. The proportion for this knowledge should be 5% of all the knowledge.

ICT Knowledge

All the study organizations have deployed ICTs as one of their strategic enablers to achieve their mandates. For instance, CMA has deployed online surveillance using ICTs in a majority of its functions. CAK uses online tools to measure the level of competition, licensing and approval processes. KenInvest is also carrying out its investment promotion activities online while KRA digitalizing the majority of their services. This, therefore, calls for all the staff in these organizations to understand the operations of the systems and other infrastructure therein. Therefore, ICT knowledge is a key component of the knowledge recipe. The proportion for this knowledge should be 4% of all the organizational knowledge.

Investor knowledge

All the study organizations engage with investors at some point. For instance, CMA engages investors while sensitizing them to invest in the securities exchange; CAK advises investors on the competition laws and the requirements for operation in Kenya; KenInvest promotes investment in Kenya; KRA advises investors to identify their tax categories and assists them in filing and payment of all the necessary returns. Therefore, the staff in these organizations require knowledge on the investors to aid them to learn how to handle them and also in making business decisions. The proportion for this knowledge should be 3% of all the knowledge.

Markets knowledge

In the financial sector, value is gained through the exchange of services and products. This exchange occurs in a market set-up. Therefore, all the study organizations operate within a specific market within their operations. Getting knowledge on the markets will aid the staff in these organizations to make informed decisions and also in solving problems based on an understanding of the market operations. This, therefore, makes the knowledge on markets to be a crucial ingredient of the knowledge recipe. The proportion for this knowledge should be averagely 2% of all the organizational knowledge.

General knowledge

Some knowledge held in the organizations is not used in their day to day operations but is needed once in a while. This does not guarantee this knowledge set to be a stand-alone set but rather it can be combined with others to form a general set which combines these knowledge components to form a complete set. Therefore, general knowledge is a key component of the knowledge recipe. The proportion of this knowledge should be 2% of all the knowledge.

Regulatory framework knowledge

The regulatory framework consists of the laws and regulations that are developed to govern specific processes. All four organizations have a regulatory mandate and therefore their staff needs knowledge on the existing framework and its application. This can also be applicable to other organizations which are regulated. The study organizations are also regulated by other government entities such as the State Corporations Advisory Committee (SCAC). They, therefore, require knowledge on the same so as to handle the review and subsequent performance reporting. The proportion for this knowledge should be 1% of all the knowledge.

References

- Al-Ali, N. (2003). Comprehensive Intellectual Capital Management: Step-by-step. New Jersey: John Wiley & Sons.

-

Alavi, M., & Leidner, D. E. (2001). Knowledge Management and Knowledge Management Systems: Conceptual Foundations and Research Issues. MIS quarterly, 107-136.

[https://doi.org/10.2307/3250961]

- Bouthillier, F., & Shearer, K. (2002). Understanding Knowledge Management and Information Management: The Need for an Empirical Perspective. Information research, 8(1), 8-1. http://informationr.net/ir/8-1/paper141

-

Castleberry, A., & Nolen, A. (2018). Thematic Analysis of Qualitative Research Data: Is it as Easy as it Sounds?. Currents in Pharmacy Teaching and Learning, 10(6), 807-815.

[https://doi.org/10.1016/j.cptl.2018.03.019]

- Creswell, J. W. (2014). Research Design. Los Angeles: United States of America: Sage.

-

Edvinsson, L., & Stenfelt, C. (1999). Intellectual Capital of Nations- for Future Wealth Creations. Journal of Human Resource Costing & Accounting, 4(1), 21-33.

[https://doi.org/10.1108/eb029051]

-

Given, L. M., Forcier, E., & Rathi, D. (2013). Social Media and Community Knowledge: An Ideal Partnership for Non-profit Organizations. Proceedings of the American Society for Information Science and Technology, 50(1), 1-11.

[https://doi.org/10.1002/meet.14505001064]

-

Holsapple, C. (Ed.). (2003). Handbook on Knowledge Management 1: Knowledge Matters (Vol. 1). Heidelberg: Springer Science & Business Media.

[https://doi.org/10.1007/978-3-540-24748-7]

-

Huck, J. R. (2009). Managing Knowledge in a Volunteer-based Community. The 6th International Conference on Knowledge Management. HongKong: ICKM 2009.

[https://doi.org/10.1142/9789814299862_0022]

- Lucena, C. I. (2016). Framework for Collaborative Knowledge Management in Organizations. Portugal: Universidade NOVA de Lisboa.

-

McCann, J. E., & Buckner, M. (2004). Strategically Integrating Knowledge Management Initiatives. Journal of Knowledge Management, 8(1), 47-63.

[https://doi.org/10.1108/13673270410523907]

- Ministry of Finance. (2017). State Corporations. http://www.treasury.go.ke/aboutus/state-corporations.html

-

Mosoti, Z., & Masheka, B. (2010). Knowledge Management: the Case for Kenya. Journal of Language, Technology & Entrepreneurship in Africa, 2(1), 107-133.

[https://doi.org/10.4314/jolte.v2i1.51994]

- Ramasami, S. (2011). Knowledge Management. Tamilnadu: Matrix knowledge books.

-

Rathi, D., Given, L. M., & Forcier, E. (2016). Knowledge Needs in the Non-profit Sector: An Evidence-based Model of Organizational Practices. Journal of knowledge management, 20(1), 23-48.

[https://doi.org/10.1108/JKM-12-2014-0512]

- State Corporations Advisory Committee. (2015). Mwongozo - The Code of Governance for State Corporations. Nairobi: The Government Press.

Humphrey Moturi is currently the Head of Records Management at Directline Assurance Company Limited in Kenya. He previously shouldered roles in library and records management in Capital Markets Authority, Bank of Africa - Kenya and the Kenya National Archives and Documentation Service. He holds Master of Science degree in Information and Knowledge Management as well as Bachelor of Science degree in Information Science from the Technical University of Kenya.

Tom Kwanya (PhD) is an associate professor in the Department of Information and Knowledge Management at the Technical University of Kenya. He is currently also serving as the Director of the School of Information and Communication Studies. Prior to joining academics fulltime in 2013, he worked as a consultant on public information and knowledge management. He has authored several refereed journal articles, book chapters and conference papers. He has also edited two books and authored two monographs. His current research interests include organisational knowledge management, indigenous knowledge management, technology in information and knowledge centres, big data analytics, infodemiology, and Internet of Things. Prof Tom Kwanya is also a research fellow in the Department of Information Science, University of South Africa.

Philemon Chebon (PhD) is currently a lecturer at the Technical University of Kenya. He has vast experience in the Library and Information Science field having worked at the Kenya National Library Service as a librarian for close to 20 years. He has also been the Africa Regional Coordinator for Children International from 2007 to 2016. He holds a PhD in Library and Information Science from the University of Cape Town, MA in Information and Library Science from the same university and a BSc. In Library Science from Loughborough University (UK).